Most people wrongly think that you need to have loads of money and lots of assets to write a Will. T...

Most people wrongly think that you need to have loads of money and lots of assets to write a Will. This simply isn’t the case. In short, you only need to have one thing and to love one person. That’s reason enough to write a Will.

When we look at some of the key reasons that people write a Will it’s because they want choice as to what happens to their assets and when. Even more important when you consider that 63% of households in England own their own homes (2020 stat).

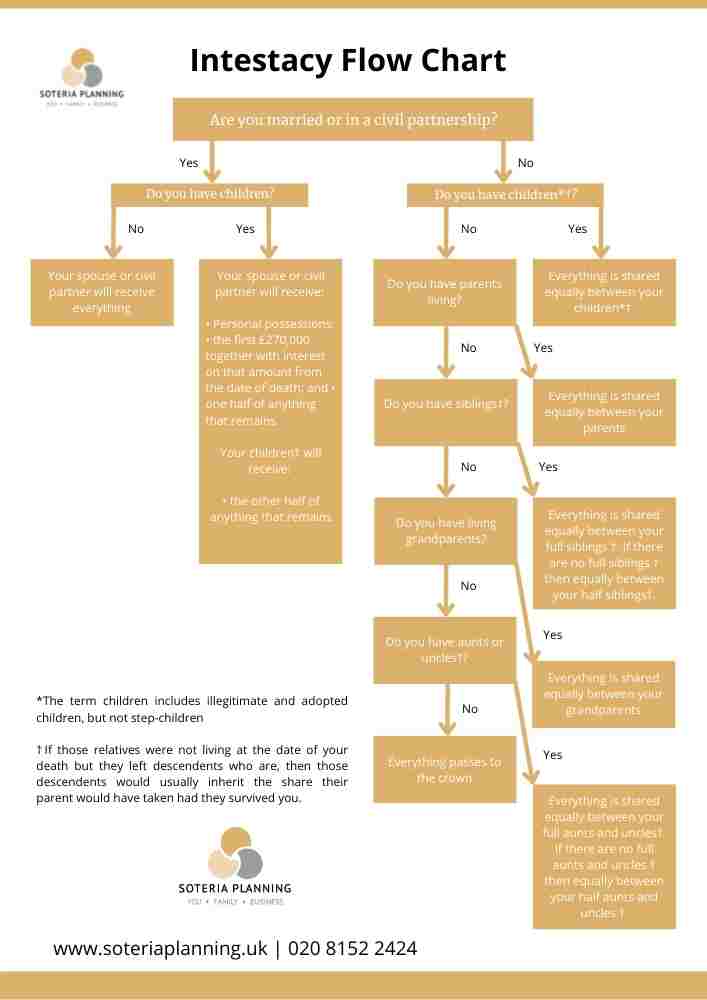

Let’s go right back to basics – A Will is the only secure way to ensure that your property and assets will pass to those you intend, in the event of your death. Without a Will, your assets are distributed according to the rules of intestacy. That’s the boring bit out of the way.

Now let’s get into a more realistic scenario. Picture this. You don’t have many assets, you don’t have ‘a lot’ of money in the bank. But what you do have, you want to go to someone very specific, and, ordinarily – that person wouldn’t inherit without a Will…

So… How would you know who will inherit and who wouldn’t?

Two ways;

Number one.

Take a look at our intestacy flowchart and assess who is likely to benefit from your estate if you don’t have a Will. Then, double check by booking a consultation with one of our friendly advisers.

Number two.

Book in a FREE (with no catch) no-obligation consultation with a friendly member of our team. They’ll go through what’s likely to stand in the way of your wishes being carried out. They’ll talk to you about some likely scenarios and they’ll understand more about your estate.

What else should you consider?

A Will is about so much more than just gifting. It’s about providing security. For example:

- Knowing who will be appointed legal guardians for children under the age of 18.

Deciding who will have the mental fortitude to be able to administer your estate and deal with an forms or financial institutions.

- Making sure that pets are provided for.

- Protecting the most valuable assets you own (often the house).

- Dealing with smaller lower value gifts; and

- Dealing with so much more.

Remember this though… You only need to have one thing and to love one person.

Speak to Soteria Planning about your Will. We have been trusted by thousands of clients and we have hundreds of 5 star reviews.

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link