Recent news from No. 10 Downing Street has sparked discussions about the potential abolition of Inhe...

Recent news from No. 10 Downing Street has sparked discussions about the potential abolition of Inheritance Tax (IHT) as a manifesto offering in the upcoming election. The government is reportedly considering this move to secure votes in key constituencies known as the “blue wall” seats for 2025. However, the possibility of scrapping IHT has raised concerns and divided opinions due to its significant impact on the government’s coffers and the potential repercussions for crucial sectors like social care.

The Significance of Inheritance Tax for Government Revenue:

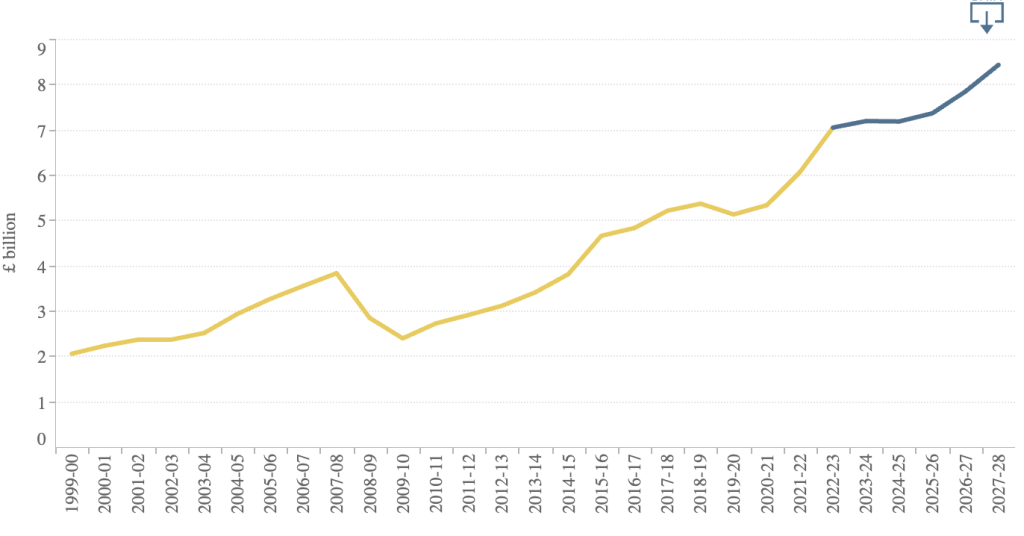

Inheritance Tax has long been a vital source of revenue for the government. According to The Office for Budget Responsibility, In 2023-24 they forecast that IHT will raise £7.2 billion in income. This increases year on year as shown by the graph below.

This tax is levied on the estate of a deceased person, and currently, any value exceeding the Nil Rate Band (NRB) is taxed at 40%. The NRB is the threshold above which the estate becomes subject to tax. The NRB was set at £325,000 for individuals and £650,000 for married couples and civil partners.

The revenue generated from IHT plays a crucial role in funding public services and government initiatives. The potential abolition of this tax would undoubtedly create a significant shortfall in government finances, forcing policymakers to seek alternative means to make up for this lost income.

Impact on Property Prices and Regional Disparities:

One of the driving factors behind the discussions about scrapping IHT is the rising property values across the country. As property prices soar, more and more estates are exceeding the IHT threshold. Particularly in the south of England, where property prices are significantly higher on average compared to other regions, a considerable number of families are affected by IHT when passing on their assets to the next generation.

The abolition of IHT would likely be welcomed by those residing in areas where property values have surged, as it would provide relief to families who may otherwise face a substantial tax burden upon inheritance.

The Unlikelihood of IHT Abolishment:

Despite the talks at No. 10 Downing Street, the potential abolishment of IHT faces significant challenges and is viewed with skepticism by many experts. The revenue generated by IHT is substantial, and finding alternative sources of income to make up for the loss would be no easy task, especially in the current economic climate. With an aging population and a pressing social care crisis, diverting funds from other essential services may not be a viable option.

Additionally, political considerations play a crucial role in shaping tax policies. While the prospect of abolishing IHT may resonate with certain voter demographics, it is essential to consider the broader implications and potential consequences for society as a whole.

Understanding the Impact through an Example:

To grasp the potential effects of IHT and its abolition better, let’s consider an illustrative example:

Suppose Mr. Smith, from the south of England, passes away with an estate valued at £1,000,000. As the Nil Rate Band is currently set at £325,000, only the remaining £675,000 would be subject to IHT at the rate of 40%. Under the current tax regime, Mr. Smith’s estate would have to pay £270,000 in IHT (40% of £675,000, leaving them with an inheritance of £730,000.

Now, if IHT were to be abolished, the beneficiaries would receive the full estate value of £1,000,000, resulting in a potential tax saving of £270,000. Please note that this doesn’t take into consideration the current Residential Nil Rate Band and that this example was used for its simplicity.

In summary, while the news of No. 10 Downing Street discussing the potential abolishment of Inheritance Tax has caught the attention of the public, the likelihood of such a significant change remains uncertain. The revenue generated from IHT is essential for funding crucial government services, and finding alternative sources of income would be challenging, particularly amidst pressing societal challenges.

At Soteria Planning, we believe that while tax policies are subject to change, it is essential to ensure that your estate planning is current and in the absence of any reforms, IHT planning is vital. Our team are on hand to support with estate planning and helping you to understand what tax considerations you might have.

Should you have any questions about the content of this blog, feel free to reach out to our friendly team on 01344 531521 or request a meeting with one of our Advisors here.

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link